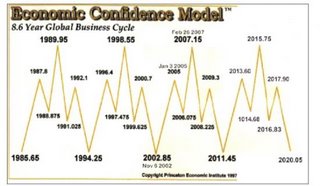

Wednesday, June 14, 2006 Economic Confidence Model

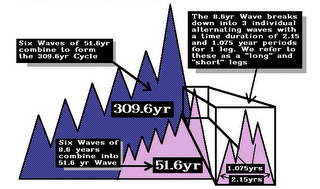

Princeton Economic Confidence Model - Private 51.6 Year Wave (1985.65 - 2037)

Research by Martin Armstrong has shown that the number of panics in a private wave, as we have been in since 1985.65, increases at least 100% over a public wave such as the last one that started in the Great Depression of the 1930's. The reason panics increase during a private wave is because of the nature of free markets, being driven by individual initiative they are inovative and fragile, perhaps like a young plant, not all seedlings will survive and grow to be strong healthy plants.

Government on the other hand is always there, no matter how badly they manage things they ultimately own everything, if a private company or individual does not pay their taxes, everthing just goes right back into the hands of government.It was Martin Armstrong's hope that knowledge of the cycles he discovered could help government to at least moderate the extreme aspects of these cycles, which as he noted led to the last world war after most of the countries in the world defaulted on their bonds (which is where most of societies money resides). 'Destroy the foundation of an economy and you create the ground for the next Hitler to rise up'.

1981 saw a huge spike in inflation with Gold hitting US$850 per ounce was predicted by Armstrong in the 1970's, that time period was also the final wave of the last 51.6 year confidence in public sector cycle (FDR's New Deal Era) leading up to the new private wave that started in 1985.65 which will end in 2037.

1985.65 (.65 of the number of days in the year) - start of the current 51.6 year private cycle - was the major turn in the British Pound/Us dollar ratio.

1987 date was the low in the US stock markets crash to the day. The model predicted the crash of 1987 to the day during which time Martin Armstrong indicated that it was not the start of the next great depression as some said, but was just the first serious panic in the emerging new private wave.

1989 cycle date was the high in the Japanese Nikkei and Martin Armstrong warned that it was going to go down 20,000 points within 10 months.

1994.25 showed the low in the SP500 to the day and the start of the dot.com mania of the 1990's.

1996 turn showed the high in the US markets at that point.

1998.55 was the high in the US stock markets to the day and led to a 20% panic sell-off and a crisis with a derivatives company which the government stepped in to save. Mr Armstrong predicted this would be a major event almost a decade before it happened! It was also the real peak in the markets as measured internally. His computer had forecast in the early 1990's that the dow would hit 6,000 by 1996 and 10,000 by 1998, the computer model had lots more in it than just the pi cycle.

1999.62 was the low in the Gold price after a 20 year bear market.2000.7 was the final high in the SP500 for the roaring 1990's bull market.

Sept.2000 saw the final high in the SP500 for the great 1990's bull market that Martin had forecast accurately a decade before. Martin predicted the markets would go sideways for 5 or 6 years after the 1990's bull market came to an end. A little more than 6 years later in early 2007 the Dow Jones made new highs.

2002.85 was the end of the bear market in the US stock exchanges, as Martin had forecast. It was also a bigger cyclical trend for rising commodity markets which Martin had forecast long before. One other thing happened on that cycle of November 8, 2002, it was the day that the UN handed down its ultimatum to Iraq to comply with its demands, not long after President George W. Bush invaded Iraq on a false charge that Iraq had weapons of mass destruction, refusing to let the UN do its job of inspections, even though the UN protested. Martin had forecast that war would increase after this turning point, although he thought it would increase with China and Russia trying to hold onto past glory with their satellites. In general Armstrong thought that this part of the cycle led to increased war which was and unfortunately, is correct.

In an article he wrote in 1999 he warned that the USA would be attacked in either Sept. or Oct. of 2001 (probably based on the 224 yr. civilization cycle which is related to the Pi Cycle) and that this would then be followed by a war in response to the attack, it all came to pass unfortunately. Very strange.

2005 turn saw a low in the US dollar index with a sharp reversal to the upside.

2007.15 is projected by Martin to be a peak in commodity prices including Gold, however it could extend out into 2012 according to him. In general the model indicated that everything would inflate again after the 2002 low, with an emphasis on hard assets - commodities, real estate etc. but given that the dow jones 30 took the lead and made new highs into the 2007 cycle date while commodities and housing (actually the Schiller Housing index peaked on the Feb. 2007 Pi Cycle date, as did the Nikkei and the Financial Indices)peaked earlier that shows that capital had turned back to stocks (especially the blue chips) again.

What lies beyond this time period is somewhat of a mystery as Marty and his computer can't talk anymore, however he has warned since at least the early 1990's that a major international debt crisis was a certainty with hyper-inflation, hence his statements - "My view of the future is not a very nice one." (had he only known that that would end up being personal premonition) and "We are going to live history."

The 51.6 year confidence in private markets wave will end in 2037 which is likely to be a major low after peaking in 2032 - this could be a variation of what we saw happen in 1929, which would then lead to another 51.6 year wave with government fal ling into favor as the savior once again, but in light of the crash of 2008 the question is: Can the USA survive this 51.6 year cycle? New information shows that the mid-point of the 51.6 year cycle hit in early 2007 and now in April 2009 we know that an economic tsunami has hit the world and Martin's long time prediction of a major financial debt crisis has begun. After 2012 when the baby boomers start to retire then the financial burden of the unfunded liabilities will start to become a serious problem and the debt crisis is very likely to intensify. Mr. Armstrong has recently in 2009 written about the wave structure in the markets looking more like the fall of the ancient Roman Empire.

10 comments:

Did you notice that the 2007.15 top for the economic cycle pinpointed the top of the U.S. Financials as XLF. There was double top in the summer and down from their in true elliottwave form to the descent in Nov 2008. Armstrong emphasized that the model was to be used with an analysis of the various sectors or indices topping or bottoming at the appointed time.

Yes that is correct, the model showed where the concentration of capital was and therefore warned of trouble to come in the financial sector. I also showed the high in the Japanese Nikkei then and a new report written by Martin from prison this Oct. warns that Japan can expect their markets to go down in terms of 1932 lows, which must mean 90% of its value will be lost. I would take that to mean that with China now competing with them they are going to lose most of their cold war advantage now.

You can read Martin's latest report here: http://www.contrahour.com/ItsJustTimeMartinArmstrong.pdf

If 2037 is coming into government as a savior what do you think of what has occur since ancient history (circa august 2008) with the government stepping in in all corners of the market, and if this isnt the shift government dependence as that is supposed to come in 2037, then what horrendous changes we can expect that are greater than todays woes.

That's a good point Ryan, As mentioned by Martin in the article above, panics increase by at least 100% during a private wave over a public wave, so in theory once we get over this panic the private wave growth should resume but I was surprised to see that in Martin's lastest 77 page document written this Oct. his confidence seemed to be shaken so badly that he mentioned the possibility of confidence moving back to government and the dow going back to 3600 or if it stays with the private sector then the dow could hit 35,000 in a hyper-inflation scenario. If only he still had his super-computer model running we would be able to see more clearly what is going on, as it is I think he did a very good job writing from prison.

Thank you so much for maintaining this website. Martin's work is absolutely fascinating. In his most recent paper (77 page document), he points to 2009.3 as being a turning point, and says that the corresponding date is March 19, 2009. I believe that was a typo, and he meant to say April (.3 x 365 = 109.5 days-- which is April 19, 2009, not March 19th). He correctly lists April 16m, 2009 as the equivalent of 2009.29 on page 26, but has a typo showing March 2009 being 2009.3 on page 25.

Well lets hope it helps Martin in the end Finster. The time error was noted by a long time follower of Martin's, broker Ross Clark.

As Steve P. said: financials topped in March 2007. And I think, by now, we all have a clue who caused this disaster: banks that, once again, reinvented the old wheel called leverage.

All the dates that Martin supplied seem to be important dates. Interpreting these dates, however, is not always easy.

Martin's insights are quite fascinating. But I don't expect anything less from someone called Martin.

Martin

I enjoyed the last article, The Ascent of China. I like the way Martin links culture with social behavior: one begets the other, in an intensifying loop. I'm also TOTALLY FASCINATED with the idea of cycles and behavior of energy in social systems. I'm impressed with how cycle theory has predicted the price action in gold. Many thanks to Martin for publishing so many informative, no-bullshit articles, free of charge.

I would like to thank you for your work and wishes you support and success.

Hope you will have time to pursue.

A swiss lecteur

Dear Swiss lecteur,

Thanks for the compliment, I am happy to know that my and Martin's thoughts are being noticed by someone from a place of high learning like yourself.

Cheers

Russ (site author and editor)

Post a Comment